Finally a quiet morning after the kids are gone to school. I’m sitting here with a fresh pot of coffee, the aroma filling the room as I look over the notes from yesterday’s FOMC event.

To be honest, it was a “quiet” affair—at least by the standards of the last few years. There wasn’t that frantic clicking of keys or the collective breath-holding we’ve grown used to. Most of us in the room already knew where the needle would land on the rate cut. That predictability gave me a rare moment of peace; I actually had time to take a proper first sip of my coffee before Chairman Powell took the podium.

In the previous last several events, tuning into an FOMC presser felt like I’d just downed a double-shot of espresso on an empty stomach and I’d be bracing for a high-intensity shock to the market. This time, my internal state was entirely different. If those past sessions were my “Red Bull” phase—all jitters and palpitations—yesterday felt like a smooth Iced Matcha Latte with a touch of vanilla. It was balanced, refreshing, and for once, I didn’t feel like I was vibrating out of my chair.

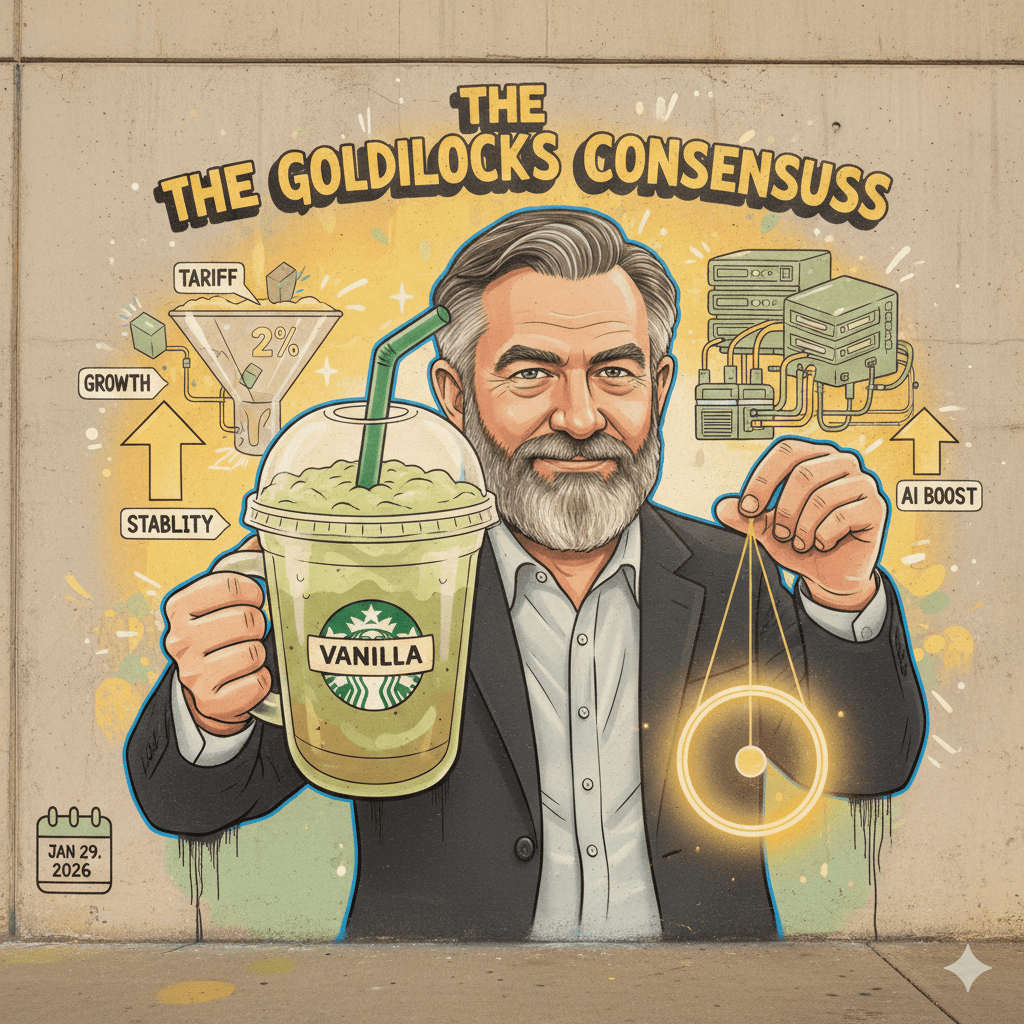

The Goldilocks Consensus: Interpreting the “Vanilla” Fed

In the world of macroeconomics, we often chase “Goldilocks”—a state where the economy isn’t too hot to cause runaway inflation, nor too cold to trigger a recession. Yesterday, Jerome Powell didn’t just find that bowl of porridge; he sat down and had a meal.

1. The Strategic Hold: Why 3.5% is the New “Just Right”

The Fed’s decision to maintain the benchmark rate at 3.5% to 3.75% was the definition of professional calm. Powell’s thesis is clear: the current policy is working. By holding steady, the Fed is effectively supporting a robust labor market while gently steering inflation back toward its 2% North Star. He’s no longer swinging a sledgehammer; he’s using a tuning fork, checking the economic vibrations meeting-by-meeting.

2. The “Tariff Filter”: Seeing the Real 2%

The most fascinating takeaway from this session—the “vanilla” sweetness, if you will—is how we should be reading inflation. On the surface, Core PCE sits at 3.0%. However, Powell pointed out a critical distinction: much of that “extra” 1% is a direct byproduct of tariffs.

Unlike traditional inflationary cycles driven by spiraling wages or demand, tariff-driven price hikes are largely one-time events. Once the market absorbs the cost, the upward pressure dissipates. When you filter out these artificial “noise” factors, the underlying inflation rate is essentially at the Fed’s 2% target. To me, this is the ultimate green light.

3. The Death of the “Tail Risks”

For months, the “Bear” narrative has relied on two ghosts: the threat of more rate hikes and the looming shadow of a recession. Yesterday, Powell essentially performed an exorcism on both:

- No Hikes: He explicitly stated that a rate increase is currently “no one’s base scenario.”

- No Recession: With GDP growth tracking between 4% and 5%, the U.S. economy isn’t just surviving; it’s thriving.

4. AI: The Economic Amplifier

Powell didn’t shy away from the “A-word.” He acknowledged that while AI might cause short-term shifts in the labor market, its role as a productivity amplifier is undeniable. It is the engine under the hood of this expansion, allowing for growth without the typical “overheating.”

The Closing Sip

After the speech, my coffee has gone from hot to that perfect, drinkable temperature. It’s a good metaphor for where the market is at right now. The scalding heat of 2022 and 2023 is gone. The bitter cold of a “hard landing” never arrived.

In this “Iced Matcha” economy, the strategy would be to stay the course. Market volatility is inevitable, and we’ll surely see a few dips throughout 2026. But when I look at the fundamental harmony Powell described, those dips aren’t warnings to flee; they are invitations to participate.

The Fed has laid out a clear, stable path. My “Red Bull” days of checking the ticker every five minutes with a racing heart are, hopefully, in the rearview mirror. So, I’m gonna take a breath, trust the fundamentals, and perhaps, next time might be English tea, maybe not. The outlook seems clearer than it’s been in years.

Hoping 2026 is the year to breakthrough.

Disclaimer:I’m an avid coffee drinker, not a fortune teller. While the “Matcha” vibes are currently high, please remember that the stock market is occasionally prone to behaving like a toddler on a sugar rush—unpredictable, loud, and prone to sudden tantrums (but I love it though, sometimes). This analysis is for informational & personal purposes; please consult with a financial advisor before betting your entire “latte fund” on a single green candle. Caffeine was harmed in the making of this article; your capital should be treated with more care.